Welcome to the Department of Computer Science at Colgate University! Computer science is the study of algorithmic processes and the machines that carry out these processes. It is a mix of theory, application, design, and experiment. Methods and ideas drawn from computer science are increasingly important in other scientific disciplines as well as the humanities and social sciences.

Our energetic faculty have active research programs and involve student researchers during the summer and the academic year. Colgate computer science students continue on to successful careers in a wide variety of fields.

The Computer Science Department at Colgate University invites applications for one or more visiting assistant professor positions beginning fall semester 2024. Colgate is a vibrant liberal arts university of around 3,200 students situated in central New York state. We welcome applications from individuals who are passionate about teaching and have the potential for excellence in teaching at the undergraduate level. Applicants with an active research agenda and interest in mentoring undergraduate research are preferred. We encourage candidates in any area of specialization to apply. Completion of a Ph.D. in computer science or a related field is required prior to or shortly after the date of hire. See https://apply.interfolio.com/141236 for details.

Thanh Dang ‘25 received an Honorable Mention for the Computing Research Association’s (CRA) Outstanding Undergraduate Researcher Award. Thanh used machine learning to uncover risk factors for Seasonal Affective Disorder under the guidance of Prof. Ahmet Ay and Prof. Krista Ingram at Colgate. Additionally, Thanh developed an evaluation infrastructure for comparing untangling tools under the guidance of Dr. Michael Ernst at the University of Washington; this work was awarded first place in the Student Research Competition at the ACM SIGSOFT International Symposium on Software Testing and Analysis (ISSTA) 2023.

At the SIGNLL Conference on Computational Natural Language Learning (CoNLL), students Anzi Wang and Aryaman Chobey presented a poster on training neural language models on a curriculum with developmentally plausible data, and Prof. Forrest Davis gave a talk on tricking language models with language illusions.

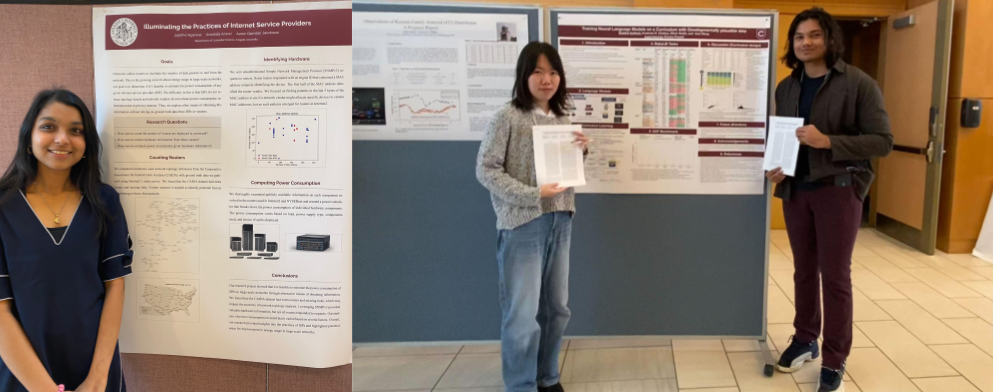

Three Colgate Computer Science students — Jaanhvi Agarwal, Anzi Wang and Aryaman Chobey — presented their summer research projects at the NY6 Undergraduate Research Conference in November 2023.